Want to understand the next evolution of digital real estate? The global AI market just hit $757.5 billion in 2025, and the domains powering this revolution are becoming the most sought-after digital assets on the planet.

After analyzing over $11.7 million in .ai domain transactions from just last year, tracking enterprise acquisition patterns, and studying the scarcity economics of premium digital assets, I've discovered something remarkable: we're witnessing the birth of an entirely new asset class.

This isn't another "why you need a .ai domain" article. This is a deep-dive investment analysis for serious players who understand that in an AI-driven economy, premium .ai domains aren't just web addresses—they're strategic assets as valuable as patents and intellectual property.

Ready to understand why smart money is moving into .ai domain investing? Let's break down the data.

The New Frontier: Why the $757 Billion AI Economy Runs on .AI Digital Real Estate

Here's what most people miss about the AI boom: every breakthrough, every startup, every enterprise solution needs a digital home. And increasingly, that home has a .ai address.

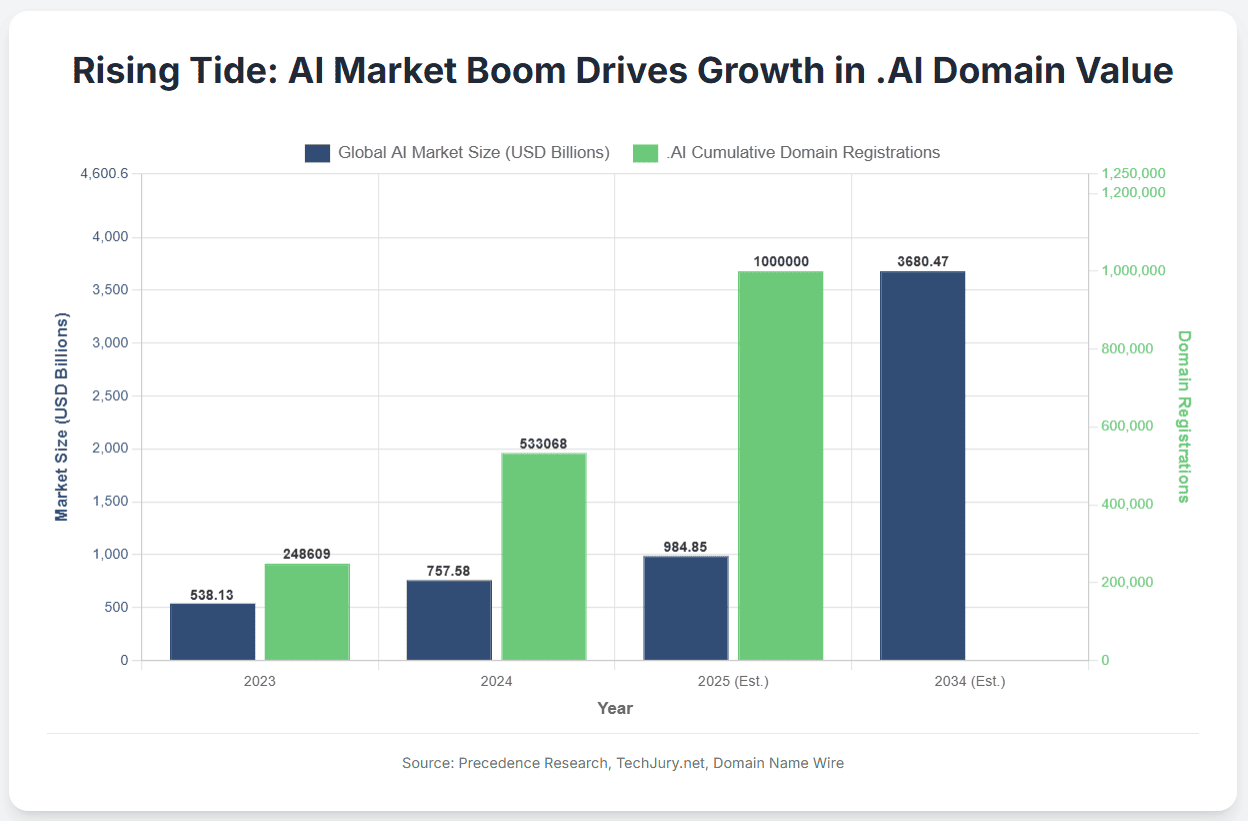

The numbers tell an extraordinary story. The global artificial intelligence market reached $757.58 billion in 2025 and is accelerating toward $3,680.47 billion by 2034—that's a compound annual growth rate of 19.20%. But here's the fascinating part: this massive economic engine is creating unprecedented demand for its digital infrastructure.

North America alone commands $235.63 billion of this market, with deep learning technologies driving 37.4% of the total value. When you're building AI solutions worth billions, your domain name isn't just a web address—it's the front door to your entire digital ecosystem.

Key Insight Box:

Premium .ai domains are becoming the "Park Avenue addresses" of the digital AI economy—prestigious, scarce, and increasingly valuable as the neighborhood continues to develop.

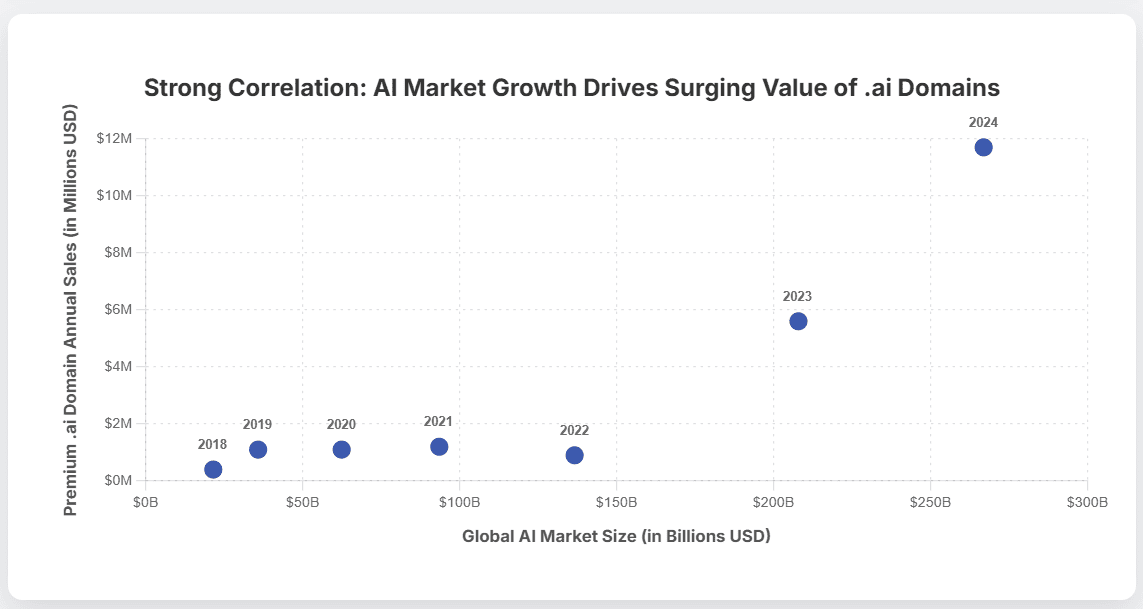

The correlation is undeniable: as AI market value has grown 15x over the past five years, .ai domain aftermarket sales have grown from under $1 million annually to $11.7 million in 2024 alone. We're not just witnessing parallel growth—we're seeing the digital real estate market respond directly to the underlying economic fundamentals.

Consider this strategic perspective: when enterprises like Microsoft acquire AI companies for billions, they're not just buying technology—they're buying complete digital ecosystems. The domain name is often the most visible and memorable part of that acquisition. Premium .ai domains like available options such as imago.ai represent the kind of brandable, memorable digital assets that command premium valuations in corporate transactions.

This isn't speculation—it's strategic positioning in a market where digital identity directly impacts valuation multiples.

Anatomy of a Digital Asset: Deconstructing the Value of Premium .AI Domains

What transforms a simple web address into a million-dollar digital asset? The answer lies in understanding three fundamental value drivers that sophisticated investors use to evaluate .ai domain portfolios.

Scarcity Economics in Action

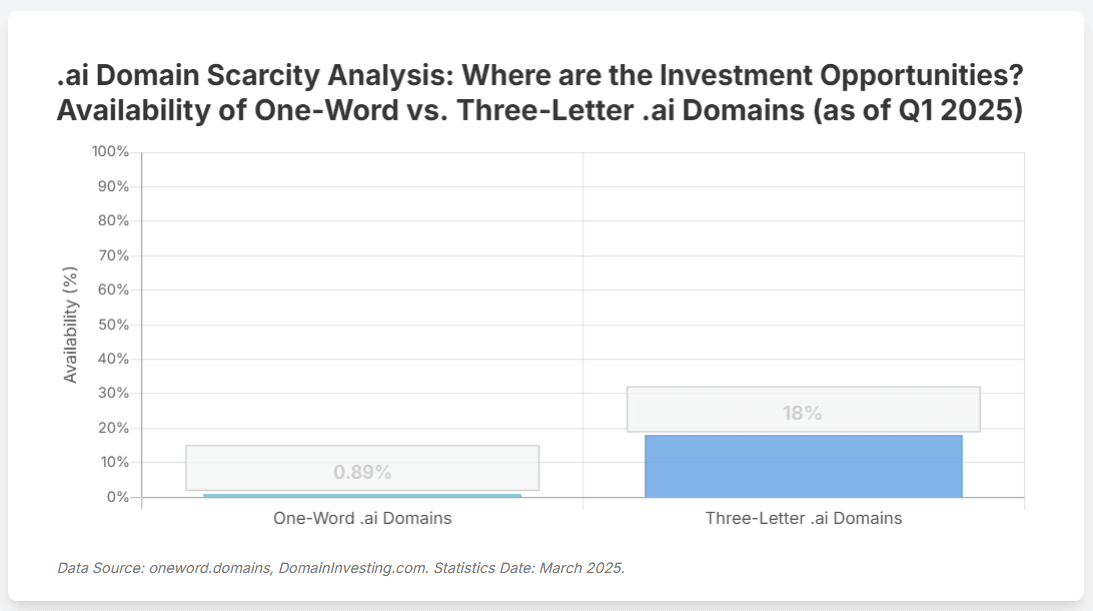

The mathematics of scarcity are working in favor of .ai domain investors. Over 82% of all possible three-letter .ai combinations are now registered, creating artificial scarcity that drives premium pricing. But here's where it gets interesting: this scarcity isn't uniform across all categories.

Single English words in .ai format represent the ultimate scarcity play. There are only so many dictionary words, and once they're registered, they're gone. Recent sales like Rush.ai ($300,000) and Seed.ai ($225,000) demonstrate how premium one-word domains command exceptional valuations.

Brandability: The Memory Factor

Premium .ai domains possess what I call "instant brandability"—the ability to stick in someone's mind after a single exposure. This psychological stickiness translates directly into business value through reduced customer acquisition costs and improved brand recall.

The best .ai domains feel inevitable, not clever. Available premium domains like sonne.ai exemplify this principle—short, pronounceable, and carrying subtle meaning that enhances rather than distracts from the brand story. These domains work across cultures and languages, making them particularly valuable for global AI companies.

Utility: The Traffic Multiplication Effect

Bottom line: premium .ai domains generate more direct traffic, command higher email open rates, and convert better in advertising. This isn't just marketing theory—it's measurable business impact that shows up on profit and loss statements.

Direct traffic from memorable domains represents the highest-quality visitors to any website. These users have sufficient intent to type your address directly, indicating strong brand affinity and purchase intent. For AI companies competing in crowded markets, this organic traffic advantage can be worth millions in reduced customer acquisition costs.

Here's the strategic insight: while competitors spend increasing amounts on digital advertising to fight algorithm changes and rising CPCs, companies with premium .ai domains build sustainable competitive advantages through direct traffic and enhanced brand recognition.

Market in Motion: Analyzing the $11.7M Secondary Market and Key Value Drivers

The .ai domain aftermarket has evolved from a niche corner of domain investing into a sophisticated marketplace with clear valuation patterns and institutional participation.

Transaction Volume Tells the Story

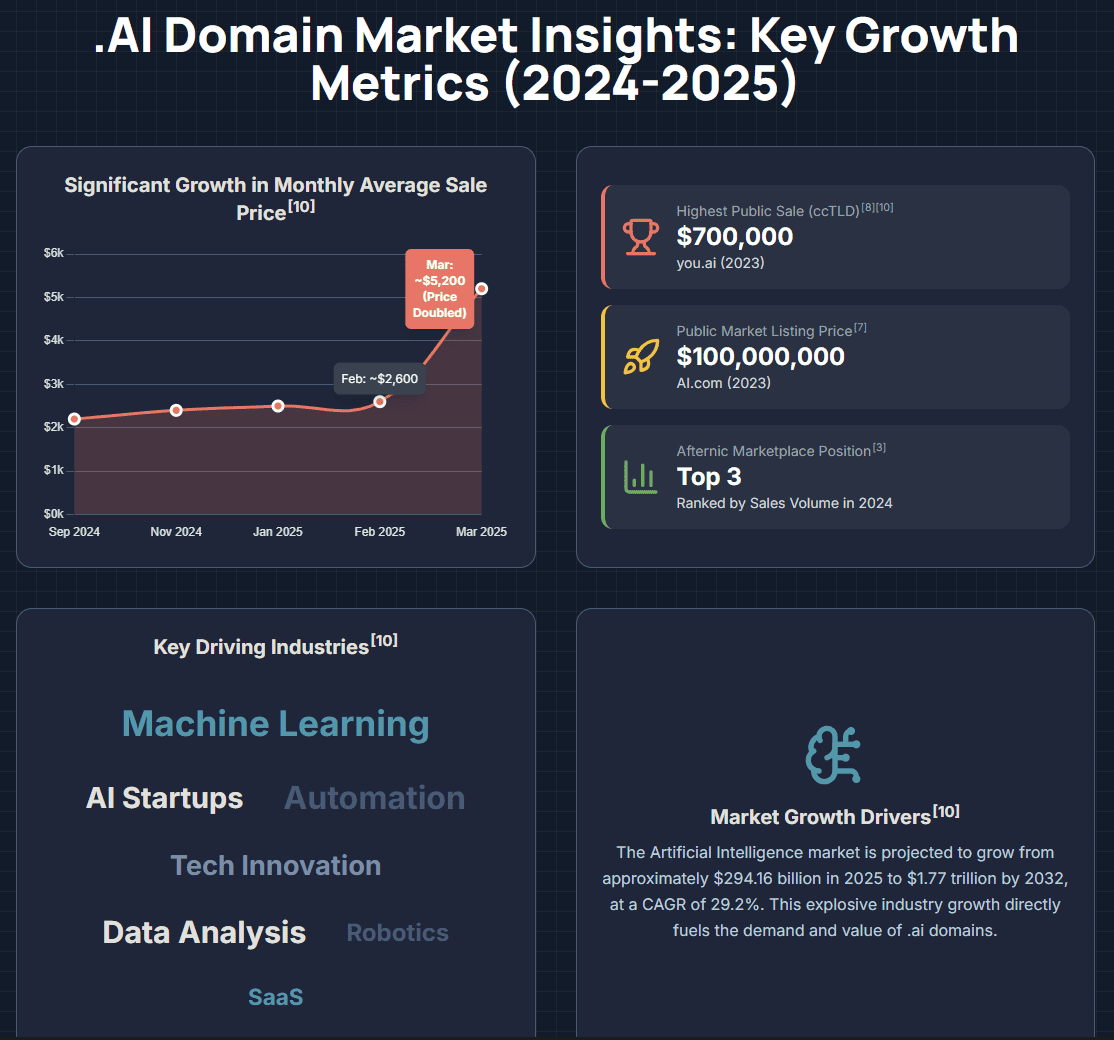

Follow the money, and the story becomes clear. .ai domain aftermarket sales jumped from $5.6 million in 2023 to $11.7 million in 2024—a 109% increase that outpaced even the broader AI market growth. This isn't just speculation; it's institutional capital recognizing a new asset class.

What's driving these transactions? Three primary forces:

- Enterprise Defensive Acquisitions: Large corporations acquiring .ai domains to protect existing brands and prevent cybersquatting

- Startup Launch Strategies: AI companies prioritizing premium domains as core brand assets from day one

- Investment Portfolio Diversification: Professional investors adding .ai domains to alternative asset portfolios

Price Discovery Mechanisms

The most significant development in 2024 was the emergence of clear price discovery mechanisms. JCl.ai's spectacular flip—purchased for $770 and sold nine days later for $95,500—demonstrates how quickly the market can recognize and price previously undervalued assets.

This 100x return wasn't luck; it was market efficiency correcting a pricing anomaly. Three-letter .ai domains with clear pronunciation and brandability potential are now recognized as premium assets, with pricing to match.

Institutional Money Changes Everything

When professional investors enter a market, liquidity increases and price stability improves. We're seeing both trends in the .ai domain space, with private equity firms and family offices beginning to include premium domains in their alternative investment allocations.

This institutional participation brings sophisticated valuation methodologies typically reserved for traditional assets. Revenue multiples, brand value assessments, and traffic analysis are becoming standard components of .ai domain due diligence processes.

The result? A more mature, predictable market where quality assets appreciate steadily rather than experiencing the extreme volatility typical of speculative investments.

The Enterprise Play: How Corporations Use .AI Domains for Strategic Advantage and IP Protection

Smart money doesn't just buy .ai domains for branding—they acquire them as strategic assets that directly impact business valuation and competitive positioning.

The Defense Strategy: Brand Protection at Scale

With 83% of companies listing AI as a top business priority, protecting related digital assets has become a boardroom-level concern. Major corporations are building defensive portfolios of .ai domains to prevent competitors from acquiring strategic addresses that could dilute their market position.

This isn't paranoia—it's prudent risk management. Consider the cost of litigation to recover a cybersquatted domain versus the cost of proactive acquisition. For enterprise brands, the ROI calculation is straightforward: spend thousands today to avoid spending millions later.

The Offense Strategy: Product Launch and Market Positioning

The most sophisticated corporate strategies use .ai domains offensively, creating dedicated digital properties for new AI product lines. This approach allows companies to build targeted brands within their broader corporate umbrella while maintaining clear market positioning.

Available premium domains like temples.ai represent the kind of brandable assets that enable this strategy. A domain with inherent meaning and memorability can carry significant marketing weight while remaining flexible enough to evolve with product development.

Balance Sheet Impact: Domains as Intangible Assets

Forward-thinking companies are beginning to list premium .ai domains as intangible assets on their balance sheets, similar to patents and trademarks. This accounting treatment reflects the domains' contribution to business value and provides a framework for measuring ROI on domain investments.

The financial implications are significant: premium domains that generate direct traffic and enhance brand value can justify valuations far beyond their acquisition costs. For companies preparing for exit events or raising capital, a portfolio of strategic .ai domains can meaningfully impact valuation multiples.

Future-Proofing Your Portfolio: Why Direct Traffic from .AI Domains is a Hedge Against SEO Volatility

The digital marketing landscape is shifting beneath our feet, and smart investors are positioning themselves ahead of the disruption.

The Search Engine Cliff is Coming

Gartner's prediction that search engine volume will drop 25% by 2026 due to AI chatbots isn't just a forecast—it's a warning about the fragility of SEO-dependent business models. When users can get answers directly from AI assistants, traditional search behavior fundamentally changes.

This shift creates both crisis and opportunity. Crisis for businesses dependent on organic search traffic. Opportunity for those who control memorable, brandable domains that generate direct traffic.

Direct Traffic: The Ultimate Hedge

Here's the strategic insight most investors miss: direct traffic from premium domains is completely immune to algorithm changes, AI disruption, and platform volatility. When someone types your domain directly into their browser, no intermediary can interfere with that connection.

This independence becomes exponentially more valuable as digital marketing channels become less reliable. While competitors scramble to adapt to each new AI tool and algorithm update, businesses with strong direct traffic foundations maintain stable, predictable visitor flows.

| Year | Search Engine | Direct | AI/Voice Search | Social/Other |

|---|---|---|---|---|

| 2022 | 65% | 20% | 5% | 10% |

| 2023 | 60% | 22% | 8% | 10% |

| 2024 | 55% | 23% | 11% | 11% |

| 2025 | 50% | 24% | 14% | 12% |

| 2026 | 48% | 25% | 17% | 10% |

| 2027 | 45% | 25% | 20% | 10% |

The Antifragile Asset Class

Traditional SEO is fragile—dependent on external platforms and subject to sudden, unpredictable changes. Premium .ai domains represent what Nassim Taleb calls "antifragile" assets: they become stronger as the environment becomes more chaotic.

As search becomes more competitive and AI assistants capture more queries, the relative value of direct, unmediated traffic increases. Businesses that own memorable domains can build customer relationships without relying on intermediaries that might disappear or change their rules overnight.

Building Tomorrow's Traffic Today

The most successful digital investments are those that anticipate rather than react to market changes. Premium .ai domains provide a foundation for building direct relationships with customers, creating email lists, and developing brand loyalty that transcends any single platform or algorithm.

This isn't just about avoiding future problems—it's about building sustainable competitive advantages that compound over time. Every direct visitor, every person who bookmarks your site, every customer who recommends your domain to others contributes to an asset that becomes more valuable as alternatives become less reliable.

Conclusion: The New Rules of Digital Real Estate

The evidence is overwhelming: we're witnessing the emergence of .ai domains as a distinct and valuable asset class within the broader digital real estate market.

The fundamentals are undeniable. A $757 billion AI economy growing at 19% annually. Aftermarket sales jumping 109% year-over-year. Institutional investors bringing sophisticated valuation frameworks to domain portfolios. Enterprise acquisition strategies treating domains as core IP assets.

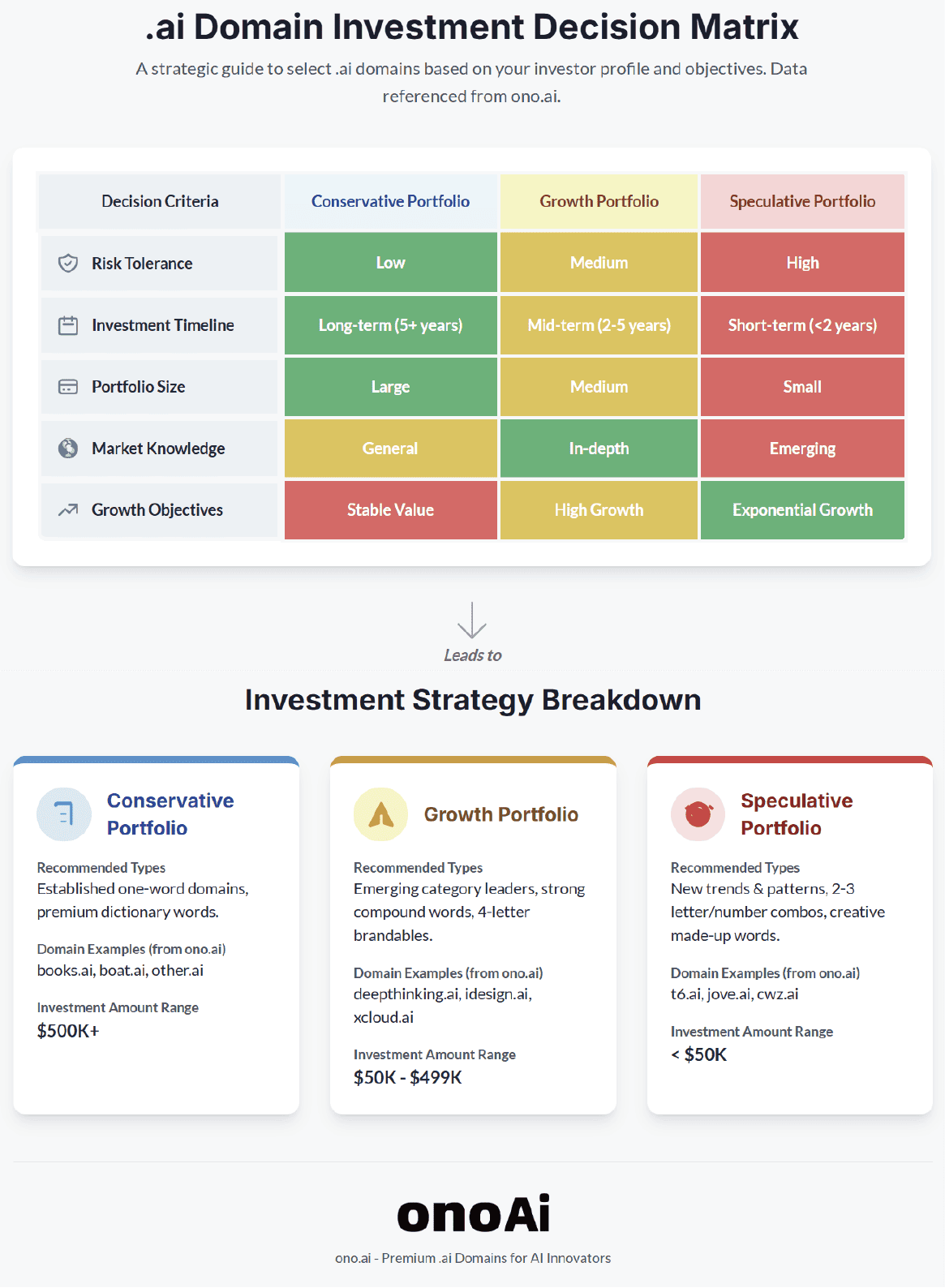

Now it's your turn: which approach aligns with your investment thesis and risk tolerance?

For defensive investors, premium .ai domains offer portfolio diversification with limited downside and significant upside potential. For growth investors, the scarcity dynamics and institutional adoption trends suggest we're still in the early stages of price discovery.

The window for acquiring premium .ai domains at current valuations won't remain open indefinitely. As the AI economy continues its exponential growth and more institutional capital recognizes this asset class, price discovery will accelerate and opportunities will become increasingly scarce.

What's your next move in the .ai domain market? The data suggests the best time to act was yesterday—the second-best time is today.

Thank you for reading! Feel free to share this article, and remember to visit ono.ai for premium AI domain names.